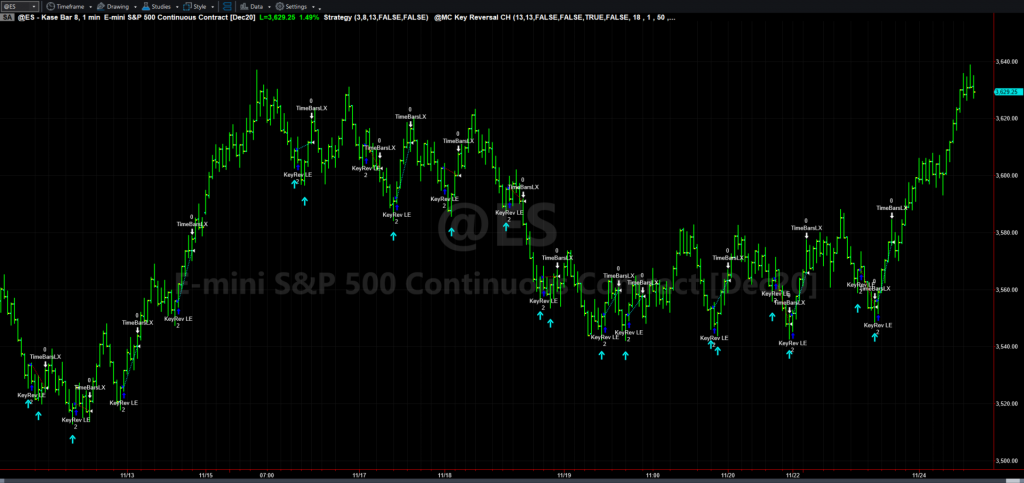

For example, a brokerage might charge you for making deposits into your brokerage account, taking money out of it or signing up for additional services. Non-Trading/Other Fees – Any form of fee for trading on this platform not covered above.Inactivity Fees – Any fees that the broker charges you for not trading, such as for keeping money in a brokerage account.Trading Commissions – This is when a broker will charge you a percentage based on the volume or value of each trade.This can come in the form of a flat fee or what’s known as the “spread.” This is when your broker charges you based on the difference, if any, between the buying and the selling price of an asset. Trading Fees – Any fixed charge attached to each trade that you make.You should look out for these when evaluating any investment or trading service: There are usually four types of fees to look out for when choosing a trading platform. Again, these tools and more are strong assets for technical, active traders who are looking for new ways to look at data before making their trades. FuturesPlus allows you to do extensive research on options and futures contracts, while Portfolio Maestro utility lets you analyze how various strategies would affect your portfolio now and into the future. Traders can set up sophisticated order types and trade based on custom-built algorithms.

S(fpxscfs1qtedrxci2dfihvxo))/images/TS03.gif)

Both its desktop and its web platforms support a high degree of customization, allowing you to see the data in ways useful to your own trading strategies. This makes it far less useful for both inexperienced investors – who may need this kind of guidance – and for less active investors – who often trade based on the companies that underlie an asset rather than the market position of securities themselves.įor investors willing to learn, however, TradeStation offers a variety of powerful utilities.

You will not find the significant news feeds, bespoke analysis or guidance that many other platforms offer. However, as suits its target audience, TradeStation offers almost no fundamental analysis within its trading platform. This is a significant edge over many comparable services that often offer basic data such as pricing and trading volumes, but fail to get into more complex metrics. TradeStation offers extensive research options for all of its asset classes, with investors able to find just about any technical indicators they would like, stretching back for the lifetime of any given asset. It is for technical traders and particularly favors active, high-volume investors who trade based on data indicators. This is a product designed for experienced investors who know exactly what they want. Much of the platform’s education and research has been moved to its website YouCanTrade, where you can choose from multiple different pricing plans based on how active a trader you are.Īll of this speaks to the core experience of using TradeStation. In addition, futures clients can trade Micro Bitcoin futures contracts through CME Group.

Cryptocurrency traders in several states can use the TradeStation Crypto platform for applying to trade Bitcoin, Bitcoin Cash, Ethereum, Litecoin and USD Coin. In addition, while TradeStation’s core brand supports options trading, it also has an independent platform for options and futures called FuturesPlus. However, many of the platform’s best research options and other tools are reserved for Desktop 10. You can trade all of the same products across the desktop, mobile and web versions of TradeStation. While the platform’s main brand is available in desktop, browser and mobile versions, it has branded its desktop client separately as TradeStation Desktop 10. TradeStation offers a somewhat dizzying array of platforms on which to trade these various assets.

0 kommentar(er)

0 kommentar(er)